Some Known Details About Retirement Income Planning

Table of ContentsExamine This Report on Retirement Income PlanningAn Unbiased View of Retirement Income PlanningRetirement Income Planning - The FactsRetirement Income Planning - The FactsGetting The Retirement Income Planning To Work

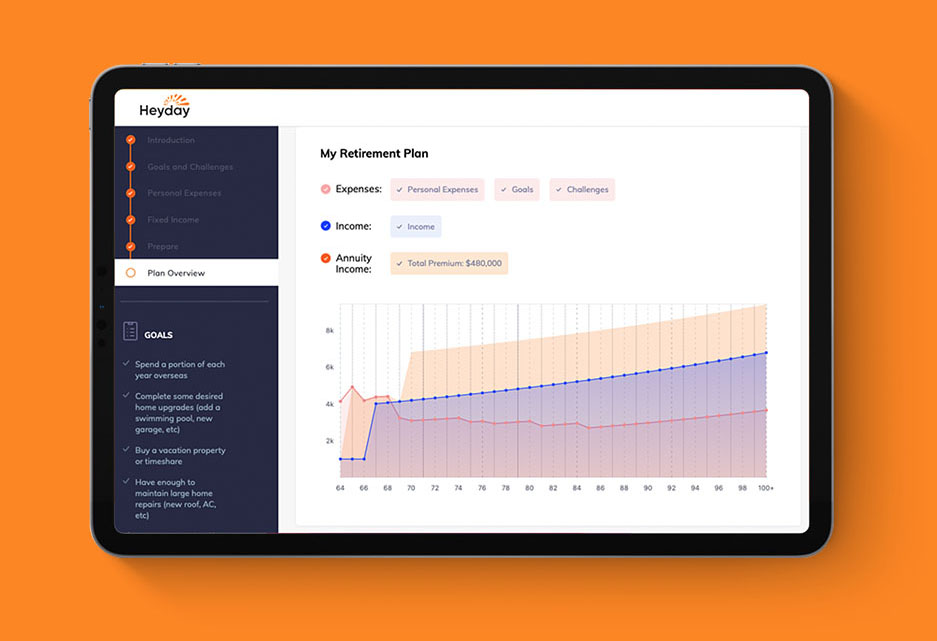

Additionally, there are alternatives to provide an advantage to your heirs, if that is an alternative that is actually vital to you. While each kind of allowance can easily provide a desirable mixture of components, partner with your financial expert to help figure out which annuity or even a blend of annuities pertains for you in building a diversified profit program.You'll wish to look at how you can spend for those exciting traits you've always hoped regarding performing when you lastly possess the timethings like trips, hobbies, and various other nice-to-haves. It's a smart tactic to purchase these sort of expenses coming from your expenditures. That's due to the fact that if the market place were to execute inadequately, you can regularly reduce back on some of these expenditures.

The 6-Minute Rule for Retirement Income Planning

Our life-spans are much longer, and also typical resources of retirement life income may certainly not give the safety they as soon as carried out. Retirement revenue organizing leverages your wide range to aid produce foreseeable earnings that meets your needs for today and also tomorrow.

Sparing along with a Roth profile, alternatively, wants income tax and may create tax-free profit when circulations are actually certified. * This indicates that if you possess a huge portion of your retirement financial savings in Roth profiles, your profit replacement rate should be lower. retirement income planning. Your marital status and also family earnings are pair of factors that have an effect on Social Security advantages and your tax obligation situation.

Many Americans have actually been seen that people of one of the most significant pieces of guidance regarding except for retirement is actually to start early. While some regard that recommendation as soon as they hear it, others require to become helped remind to save. Even more than 38 million people (that is actually Forty five% of working-age households in the U.S.) have no retirement cost savings at all.

The Definitive Guide to Retirement Income Planning

Whether you are just beginning or are actually better to retirement life, you'll would like to ensure that your revenue lasts provided that you require it. The promoting headlines is that, no matter where you go to whether it is actually in advance or even at the back of there are actually some basic things you can easily start carrying out today to much better get ready for a pleasant retired life.

Coming from certainly there, figure out if there are any type of very easy ways you may reduce on needless investing, as well as save that newfound funds in a retirement fund. Bank card personal debt can be actually a major drawback to retirement preparing. If you possess credit report memory cards with high rate of interest, settle the financial debt asap to ensure that as an alternative of paying for the large rate of interest on your expenses, you may incorporate that money to a retirement cost savings account.

The juice machine describes the kind of retirement revenue planning evaluation our team make use of to help you receive all revenue you may (within explanation) coming from the sources you actually have (retirement income planning). Just how does it operate? Our team run iterations of your program to find ways you can: Apply a guidelines based technique to your investment selections, Reduce investment expenditures, Correlative your income sources in a tax obligation reliable means, Minimize your risk of lacking money, Create reputable resources of retired life earnings, Think about, or additional resources all around, booked deferred comp payments, Case Social Surveillance in a means to make best use of capital, Smartly departure concentrated positions in provider share, Use Roth sales to your benefit More extract could be determined in relations to improved after-tax cash money flow, a higher chance of success, and/or extra properties offered to pass along to inheritors.

The 20-Second Trick For Retirement Income Planning

Can our experts ensure our experts can raise your retired life revenue through this organizing method? Of training program certainly not. The end results of this procedure are particular to your data and also household conditions, which is actually as it should be actually. Our team carry out discover that our team can usually present you which choices will certainly create a relevant distinction.

There are many factors to take into consideration when it relates to ensured retirement profit. visit our website Just how much cash will you need? What kind of guaranteed retirement earnings strategy is best for you? How can you ensure your money will last throughout your retirement life years? Within this guide, our experts will definitely address these concerns and also even more! We are going to explain exactly how to empower retired life through spending in promised retired life profit and the various forms of plans readily available.

5 Simple Techniques For Retirement Income Planning

Yet another argument would be if the system would certainly still be around in the future or change entirely coming from today's standards, which may be a massive wrench in any plan. Currently, annuities are actually the only retired life planning that assures a salary for a whole entire life-time or lifetimes, in the profile. Allowance owners may regulate the quantity of desired profit they see acquire down the road via delayed annuity strategies.

You function hard for your loan. You really want to ensure that it is going to be actually there when you require it whether for retirement, a stormy day fund, or even one thing else. When it happens to retirement life profiles, there are a lot of misconceptions floating around.